How to Track Your Small Business Cash Flow

Methods to Hookup 2 Monitors to Desk Top PC

29. augusta 2022As to why Do People Online Particular date?

30. augusta 2022

Roper has a proven, long-term track record of compounding cash flow and shareholder value. The Company operates market leading businesses that design and develop vertical software and technology enabled products for a variety of defensible niche markets. Roper utilizes a disciplined, analytical, and process-driven approach to redeploy its excess free cash flow toward high-quality acquisitions. Additional information about Roper is available on the Company’s website at

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

Using the cash flow statement example above, here’s a more detailed look at what each section does, and what it means for your business. Since it’s simpler than the direct method, many small businesses prefer this approach. Also, when using the indirect method, you do not have to go back and reconcile your statements with the direct method. The cash flow statement takes that monthly expense and reverses it—so you see how much cash you have on hand in reality, not how much you’ve spent in theory. Monitoring cash flow means not only looking at past performance but also at projections of what your cash flow will be in the future.

Cash Flow from Investing Activities

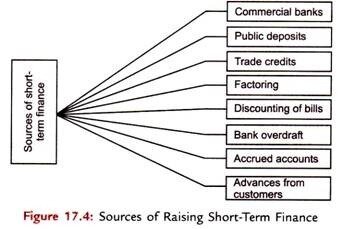

These insights can help with decision-making by using the right KPIs to get clear on what you’re wanting to achieve. To stay on top of your financials, there are a few key cash flow metrics and KPIs you can track that will help you make the right decisions and avoid insolvency or liquidation. Different types of cash flow can offer different insights into your business‘ finances.

Breathitt County Schools celebrates exit from state assistance – Kentucky Teacher

Breathitt County Schools celebrates exit from state assistance.

Posted: Wed, 15 Mar 2023 12:53:07 GMT [source]

Analysts look at free cash flow to understand the true profitability of a business. Companies with strong financial flexibility can take advantage of profitable investments. They also fare better in downturns, by avoiding the costs of financial distress.

Accounts Receivable Template

In fact, managers frequently consider this metric when assessing the efficiency with which their department heads utilize funding. As a result, UFCF can be an incredibly useful tool for budgeting money. A cash flow app is a mobile application that allows you to track your cash flow anytime and anywhere using your smartphone or tablet.

Always consult with a professional accountant before making major financial decisions that could impact the future of your business. To combat this struggle and stabilize your cash flow, you can incorporate several tactics into your business model. If you prefer that we do not use this information, you may opt out of online behavioral advertising. If you opt out, though, you may still receive generic advertising. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. Bank of America, N.A., Merrill, their affiliates and advisors do not provide legal, tax or accounting advice.

How to manage cash flow

This allows you to make decisions that can help your business veer away from red ink and stay firmly in the black. And this, in turn, helps your business run much more smoothly — and stay ready for bigger opportunities you can’t take advantage of if you’re struggling just to keep up. The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

It helps you automate your data entry, sync your bank accounts, generate reports and charts, and receive alerts and reminders. A cash flow app can also help you collaborate with your team, share your data with your accountant, and integrate with other tools and platforms. There are many cash flow apps available in the market, such as QuickBooks, Wave, FreshBooks, and Xero. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows and outflows that a company receives.

Here are some of the best https://bookkeeping-reviews.com/ or methods to use for your small business. Having a positive cash flow means there’s more money coming in while a negative cash flow indicates a higher degree of spending. The latter isn’t necessarily a bad thing because it may mean that you’re investing your money in growth. But if your spending becomes excessive, you won’t have enough for a rainy day and you won’t be able to pay your suppliers or lenders. Whether you’re running a business or a household, it’s important to keep on top of your cash flow.

Cash flow consists of the flow of funds into and out of your business. It’s crucial to understand what cash flow is and how to keep track of it — especially for small businesses that may not have huge cash reserves. Simply put, if you don’t pay attention to your cash flow, you may find yourself without the money to pay your bills. See how easy it is to track and manage your cash flow statement with a template in Smartsheet. You can use this template to perform a cash flow sensitivity analysis in order to anticipate shortfalls and help your business maintain a positive cash position. This analysis can help you make more accurate cash flow predictions and inform your business decisions.

The most important aspect of managing cash flow is to constantly monitor it. You need to know how much money your company is taking in as well as how much of that money you have on hand to use. If you have an accurate idea of your company’s cash flow, you can follow these simple tips to increase cash flow and manage your business. Proper cash flow management is a key strategy that every business owner must master for long-term financial success. Managing cash flow can be one of the biggest challenges business owners face. However, few currently available apps properly integrate with your business current account, meaning you still have to perform admin tasks just to get access to routine business information.

Keeping up with learning xero receivable will prevent a cash crunch. A quick and easy way to perform a cash flow analysis is to compare your total unpaid purchases to the total sales due at the end of each month. If the total unpaid purchases are greater than the total sales due, you’ll need to spend more cash than you receive in the next month, indicating a potential cash-flow problem.

The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flow—the precise amount of cash you have on hand for that time period. PlanGuru offers cash-flow forecasts, budgeting, financial analytics and strategic planning tools for small businesses. They provide more than 20 forecasting methods that allow you to project models for up to 10 years.

The most expensive way to generate a cash flow statement is by hiring an accountant or bookkeeper. However, if your business is fairly large and complex, you probably need an accountant’s expert guidance to ensure your business is on track for success. Even if you have a smaller, less complex business, it’s still wise to consult with a financial advisor . Direct cash flow statements are the simplest cash flow statements. These statements only show your physical cash transactions and don’t list your net income at the top of the sheet. Instead, these statements just list each cash transaction in order by date.

How to leverage equipment finance banking solutions to minimize … – The Business Journals

How to leverage equipment finance banking solutions to minimize ….

Posted: Mon, 06 Mar 2023 06:00:00 GMT [source]

It’s important to have detailed budgets and to curb unnecessary spending. You can find a lot of extensive breakdowns on cash flow statements. Here are some basic terms and elements of a cash flow statement you’ll need to know in order to create and read yours. An important element of your business model that can help with cash analysis is proper accounting standards.